Best Trade of the Week: Top Trade Setup and Market Insights

Every week, the forex market presents unique trading opportunities, but only a few stand out as the best trade of the week. This trade is selected based on high-probability setups, strong technical patterns, and fundamental catalysts that drive price action.

Profitable Market Opportunity

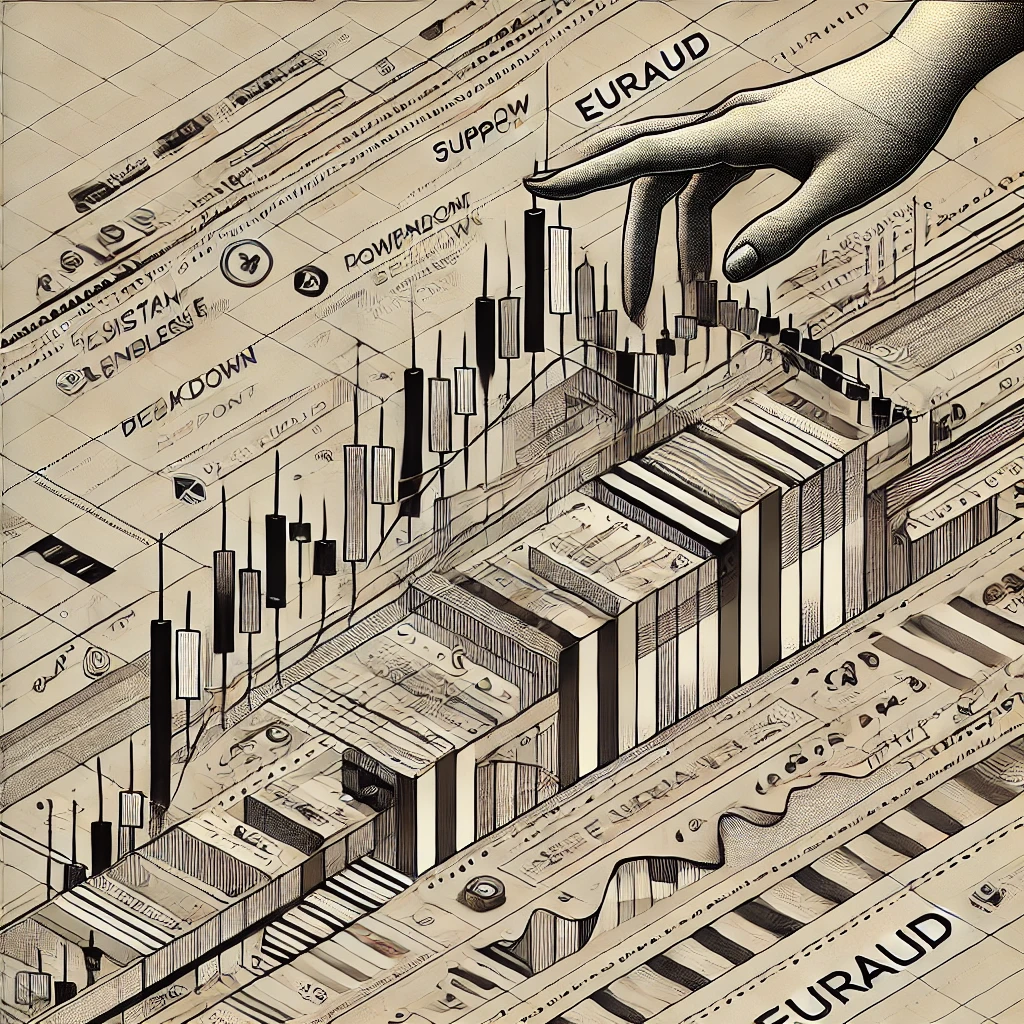

This week’s best trade setup comes from a strong market movement driven by key economic events. A major currency pair, such as EURAUD AND GBP/USD, showed a clear breakout after a period of flag, presenting an ideal entry point for traders.

Trade Analysis:

- Entry Point: Identified based on technical indicators like moving averages and RSI.

- Market Catalyst: Economic news, central bank decisions, or geopolitical factors.

- Risk Management: Stop-loss and take-profit levels set to maximize gains while minimizing risk.

This trade highlighted the importance of timing and strategy in capturing high-probability setups. Stay tuned for next week’s top trading opportunity! 🚀

Trade Breakdown:

📉 Pair: EUR/AUD

📉 Trend: Strong Downtrend

📉 Entry Point: After a confirmed breakdown below support

📉 Indicators Used: Moving Averages, RSI, and Volume Analysis

📉 Catalysts: Economic data from the Eurozone & Australia, interest rate differentials

The trade was a great example of how technical and fundamental analysis align to create profitable setups. Stay tuned for next week’s top trade! 🚀

In terms of market structure, if you’re considering a short trade on EUR/USD, it would align if the market is in a bearish trend (moving downward).

Here are key points indicating that the market is in a bearish structure, which would be suitable for a short trade:

- Lower Highs and Lower Lows – In a bearish market, you’ll notice that the “higher highs” and “higher lows” are replaced with “lower highs” and “lower lows.”

- Break of Structure (BOS) – If the price breaks a previous support or key level, indicating that the market sentiment is shifting downward, it may present a good opportunity for a short trade.

- Candlestick Patterns – Patterns like “bearish engulfing” or “shooting star” at resistance levels could confirm a bearish move and strengthen the short trade setup.

- Momentum – Using indicators like the RSI (Relative Strength Index) or MACD to confirm that the market is overextended and likely to continue its downward movement.